Industry Observation | Construction Machinery Entering a New Cycle

2025-11-10

As of the end of September 2025, the Shenwan Machinery Equipment Industry Index had risen by 37% year-to-date, ranking sixth among all first-level industries and significantly outperforming the market. Leading companies with market capitalizations exceeding 100 billion yuan, such as Sany Heavy Industry and XCMG, saw their share prices reach record highs in March. Core component manufacturers like Hengli Hydraulics also saw gains exceeding 50%, while Sunward Intelligent experienced nine consecutive daily price limits within 15 trading days, driven by mega-projects, reaching a near ten-year high.

This round of gains is driven by industry fundamentals. The construction machinery sector, fueled by cyclical reversals, explosive growth, and rising exports, may be entering a new upward cycle.

Reviewing the previous cycle

In the previous construction machinery cycle (approximately 2016 to 2021), the performance of related stocks presented a complex picture of high correlation with industry prosperity, yet also implicitly involving game theory. This cycle, which began in 2016, was driven by the implementation of domestic infrastructure projects, improved real estate construction, and strong demand for equipment replacement.

The share price of Sany Heavy Industry, the leading company, rose from its low point in the first half of 2016, increasing by approximately 70% by August 2017. Its overall upward cycle lasted about 4.5 years, until the first quarter of 2021. Unlike the earlier periods of sharp fluctuations, this cycle, dominated by demand for replacement of existing equipment, exhibited better continuity than before, leading the market to initially expect reduced volatility.

However, the turning point of the cycle eventually arrived. A key pattern is that stock price peaks often precede the overall turning point in industry prosperity, accompanied by changes in micro-indicators. For example, the stock prices of Sany Heavy Industry and its core component supplier Hengli Hydraulics both experienced significant corrections after the 2021 Spring Festival, falling by more than 40% from their previous highs.

Even more dramatically, macroeconomic data for the industry remained high at this time: in the first quarter of 2021, Sany Heavy Industry's revenue hit a record high, Hengli Hydraulics' net profit increased by a staggering 140% compared to the same period in 2019, and domestic excavator sales in March also saw a year-on-year increase of 56.6%. This significant divergence between performance and stock price became a strong warning signal. The market was more focused on the weakening of leading indicators, such as the month-on-month decline in excavator sales—domestic sales in April 2021 were expected to fall sharply from the March high—and the industry association's cautious forecast of a high-then-low growth for the whole year.

The performance of individual stocks during the cycle also revealed their different elasticities and risk structures. Throughout the upward cycle, the revenue growth elasticity varied across different product segments. For example, during the upward phase from 2016 to 2021, Sany Heavy Industry's excavator revenue increased by 459%, concrete machinery revenue by 181%, while crane machinery revenue, due to a lower base, saw a staggering 707% increase. This difference in business structure directly impacted the ultimate height and sustainability of the stock prices of related listed companies. Furthermore, the valuation models used by the market for cyclical stocks significantly amplified volatility near inflection points.

During industry booms, although corporate profits are at their peak and price-to-earnings ratios appear low (e.g., Sany Heavy Industry's price-to-earnings ratio once fell below 11 in 2021), this is often a so-called "low P/E trap." Investors, fearing a downturn, sell off in advance, causing stock prices to begin a significant correction even when profits are still substantial. Leading companies like Sany Heavy Industry, Zoomlion, and XCMG all saw significant pullbacks from their 2021 peaks.

This cycle also highlighted the potential value of the "export logic" in mitigating the risks of a domestic cyclical downturn. As early as around 2008, industry leaders had already begun their international expansion. When the domestic market began to weaken in 2021, Sany Heavy Industry's overseas revenue surged by 76% year-on-year, offsetting to some extent the decline in domestic revenue. This prompted the market to re-evaluate the growth attributes of construction machinery stocks, namely, using increased overseas revenue to smooth out the strong cyclicality caused by fluctuations in domestic investment.

However, even with the logic of going global, it is still difficult to completely offset systemic downward pressure in the short term in the face of a strong domestic cyclical turning point. Looking at Sany Heavy Industry's case, its performance growth has consistently shown a spiral upward trend; for example, its revenue in 2015 was lower than that in 2010, indicating that attempting to completely smooth out the impact of cycles is extremely difficult in practice.

What's different about the new cycle?

Compared to the previous cycle, the current recovery of the construction machinery market exhibits more complex structural characteristics. Its driving logic has shifted from simple investment-driven growth to a combination of domestic inventory replacement, global expansion, and technological paradigm shifts.

From a demand structure perspective, the internal support for this cycle is more diversified. In addition to traditional infrastructure investment, the recovery of the domestic market is more strongly driven by the combined effects of equipment lifecycle replacement and mandatory environmental policies. According to industry data, the theoretical replacement cycle for major equipment such as excavators is approximately 8 to 10 years, and equipment from the previous sales peak (approximately 2016 to 2018) has entered a concentrated replacement window.

Meanwhile, since the release of the "Action Plan for Promoting Large-Scale Equipment Replacement and Trade-in of Consumer Goods" in 2024, many local governments, such as Hefei and Chongqing, have issued detailed rules for phasing out older non-road mobile machinery with emission standards of National II and below. By using administrative means to accelerate the clearing of existing equipment, they have created a more definite space for a new round of equipment sales. This makes the resilience of this round of domestic demand recovery stronger than in the past. According to institutional statistics, domestic excavator sales increased by 21.5% year-on-year from January to August 2025. This sustainability relies not only on new investment but also on a massive existing equipment replacement base.

In terms of coping with domestic cyclical fluctuations, leading companies have built key "performance stabilizers" through deep globalization. "Going global or going out of business" has become an industry consensus. Companies' overseas strategies have evolved from simple trade exports in the early years to deep internationalization through establishing production bases, R&D centers, and marketing and service networks locally. In 2024, XCMG, Sany Heavy Industry, and Zoomlion accounted for 12.4% of the combined sales revenue of the world's top 50 construction machinery manufacturers, demonstrating the continued rise in the influence of Chinese brands in the global market.

More importantly, overseas markets are not only a supplement to scale but also a guarantee of profitability quality. Data shows that the gross profit margin of many OEMs' overseas sales continues to be higher than that of the domestic market, with some companies' overseas revenue accounting for as much as 60%. This fundamental change in revenue sources gives companies stronger risk resistance and performance smoothing capabilities when facing fluctuations in the domestic market. Looking to the future, the most profound differentiator in this cycle is the redistribution of industrial value brought about by technological iteration. The transformation of construction machinery into a "new quality productivity" sector is taking shape, with the core being the deep integration of electrification and intelligentization.

At the 4th Changsha International Construction Machinery Exhibition, electrified products took center stage. Sany Group's exhibited equipment included 40% new electrified products, and its sales of electrified products exceeded 10 billion yuan in 2024. This is not merely a shift in energy form, but a reshaping of product value and the industrial chain—while electric products offer advantages such as zero emissions and low noise, their higher value and more complex electronic control systems are raising the industry's technological barriers and increasing the added value of the industrial chain.

Meanwhile, intelligentization is propelling equipment from "steel machinery" to "engineering robots." For example, unmanned road rollers and remotely controlled excavators have moved from concept to application. This indicates that future industry competition will be a competition of technology, data, and ecosystem, potentially helping leading companies escape the cycle of homogeneous "price wars."

In this cycle, listed companies are navigating the cycle by developing a three-pronged strategy encompassing "domestic replacement demand, global revenue, and electrified products." The core idea is to shift from passively adapting to macroeconomic cycles to proactively building diversified growth engines and higher technological barriers, aiming to achieve a more stable growth curve and valuation center in the new industrial competitive landscape.

Relevant News

-

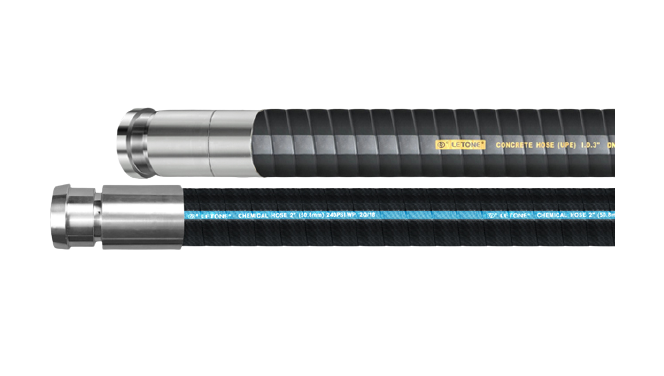

Innovation Empowerment | SUPER ARTERY LOW BEND SERIES Super Hercules Low Bend Series Hose

-

Kerosene cleaning objects and methods

-

Letone Hydraulics sincerely invites you to participate in the "19th Beijing Petroleum and Petrochem

-

Yu Wei, Deputy Mayor of Luohe City, came to investigate

-

Letone Hydraulics sincerely invites you to participate in the 19th China International Petroleum and

-

Letone Hydraulics sincerely invites you to participate in the "Germany Hannover Messe" and "BMW E

-

Letone Hydraulics (Booth No.10152) will meet you at the 2024 Abu Dhabi International Petroleum Expo

-

Up to $1.8 billion! High US tariffs could severely damage the construction machinery industry!