India drastically reduces tire excise tax rate, bringing significant benefits to multiple product ca

India recently announced a reduction in the Goods and Services Tax (GST) on new pneumatic tires to 18% and on tractor tires, inner tubes, and bicycle tires to 5%, effective September 22, 2025.

This decision was made based on recommendations made at the 56th meeting of the Goods and Services Tax Board on September 3, and falls under the category of a two-tiered tax reform aimed at simplifying tax rates and stimulating consumption. Tire manufacturers stated that tire prices will be lowered to reflect the new tax structure.

What changes will occur on September 22, 2025?

New pneumatic tires (cars, motorcycles, buses, trucks): 28% → 18%.

Tractor tires and inner tubes: 5% at the preferential tax rate bracket.

Bicycles and other non-motorized vehicle categories: Tax rate adjusted to 5%.

The Excise Commission's annex includes "new pneumatic tires" (excluding bicycles, rickshaws, tractor rear wheel tires, and aircraft tires) in the 28% → 18% tax rate adjustment, and tractor tires/inner tubes in the 18% → 5% adjustment; as part of broader tax rationalization measures, bicycles are separately adjusted to a 5% tax rate.

Industry reaction

CEAT has confirmed that it will pass on the reduced GST to customers and dealers. As CEAT Managing Director and CEO Arnab Banerjee stated, "We expect sales of commuter motorcycles to increase in semi-urban and rural households, and sales of agricultural machinery may also rise."

Indian automotive media also reported that CEAT has lowered prices across its commercial, agricultural, passenger, and two-wheeled vehicle product lines in line with the implementation of GST 2.0.

Why is it important to the industry?

The reduction in India's tire excise tax has directly lowered the price of replacement tires, particularly in price-sensitive sectors such as commuter motorcycles and agricultural machinery. Analysts and OEMs expect inquiries to increase and unit demand to gradually rise as prices reset during the festive season.

CEAT has been investing in capacity, including a planned capacity expansion for passenger cars and light commercial vehicles in Chennai announced in August 2025 – a significant development given the lower tire excise tax's contribution to improved capacity utilization.

Comparison of Excise Taxes on Indian Tires:

| Tyre type | The old consumption tax rate | New consumption tax rate | Effective Date |

| Newly inflated tires for cars, motorcycles, buses and trucks | 28% | 18% | 2025.9.22 |

| Tractor tires and inner tubes (including the rear wheels of the tractor) | 18% | 5% | 2025.9.22 |

| Bicycle/Non-motorized Category | 12% | 5% | 2025.9.22 |

-

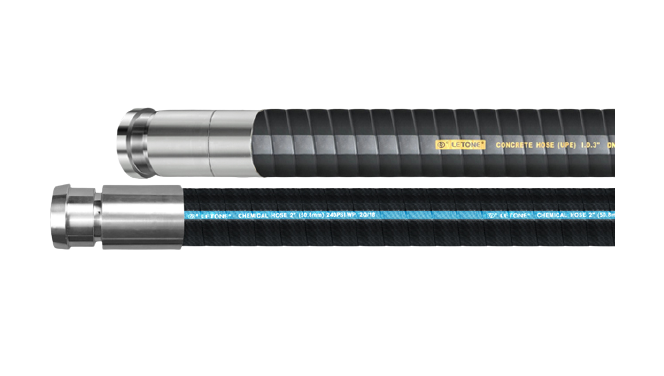

Innovation Empowerment | SUPER ARTERY LOW BEND SERIES Super Hercules Low Bend Series Hose

-

Kerosene cleaning objects and methods

-

Letone Hydraulics sincerely invites you to participate in the "19th Beijing Petroleum and Petrochem

-

Yu Wei, Deputy Mayor of Luohe City, came to investigate

-

Letone Hydraulics sincerely invites you to participate in the 19th China International Petroleum and

-

Letone Hydraulics sincerely invites you to participate in the "Germany Hannover Messe" and "BMW E

-

Letone Hydraulics (Booth No.10152) will meet you at the 2024 Abu Dhabi International Petroleum Expo

-

Up to $1.8 billion! High US tariffs could severely damage the construction machinery industry!