Half-year report reveals that the entire industry is in decline, but leading companies are perseveri

2025-09-10

Once a shining star in the construction machinery industry, aerial work platforms enjoyed astonishingly high annual growth rates. For example, in 2021, domestic sales of aerial work platforms grew by 54.6% annually. However, the industry situation took a sharp turn for the worse in 2024. Sales of aerial work platforms in my country reached 179,900 units in 2024, a year-on-year decrease of 12.88%, marking the first annual decline.

In the first half of 2025, the downward trend in the aerial work platform industry continued. Looking at the interim reports of construction machinery companies, many companies experienced a decline in revenue and profits from their aerial work platform divisions, exacerbating the pressure on these businesses.

The high-tech sector is under overall pressure.

Looking at the overall performance of listed construction machinery companies in their 2025 interim reports, most companies covering the aerial work platform (AAP) segment experienced a decline, but some bucked the trend and grew.

Zhejiang Dingli achieved operating revenue of 4.336 billion yuan in the first half of the year, a year-on-year increase of 12.35%; net profit attributable to the parent company was 1.052 billion yuan, a year-on-year increase of 27.63%, with the net profit margin further improving to 24.27%. Against the backdrop of fierce industry competition and escalating overseas trade frictions, Zhejiang Dingli achieved double-digit growth in both revenue and profit through refined management and differentiated competitive advantages, demonstrating strong operational resilience.

Zoomlion reported revenue of 2.592 billion yuan from its AAP segment during the reporting period, accounting for 10.43% of the company's total revenue, a year-on-year decrease of 34.47%. Although revenue declined, relying on continuous technological innovation, Zoomlion has gradually gained global pricing power in the ultra-high-altitude AAP segment. Currently, Zoomlion holds the number one global market share for ultra-high-reach straight boom lifts, and its world's tallest 82-meter ultra-high-reach straight boom lift has obtained EU CE certification; its high-reach articulated boom lift product, the ZA32J, also holds the number one global market share.

XCMG's aerial work platform segment achieved revenue of RMB 4.572 billion in the first half of 2025, accounting for 8.34% of the group's revenue, a year-on-year increase of 1%.

Luxiao Technology's aerial work platform segment achieved operating revenue of RMB 379 million, accounting for 21.60% of the company's operating revenue, a year-on-year decrease of 29.88%.

Furthermore, the two leading listed companies in the downstream aerial work platform leasing market are experiencing contrasting development trends. According to Hongxin Construction Development's semi-annual report, in the first half of 2025, Hongxin Construction Development achieved revenue of RMB 4.35 billion, a year-on-year decrease of 10.7%; gross profit was RMB 941 million, a year-on-year decrease of 39.7%. Hainan Huatie's semi-annual report shows that in the first half of 2025, it achieved total operating revenue of RMB 2.805 billion, a year-on-year increase of 18.89%; and net profit attributable to shareholders of the listed company was RMB 341 million, a year-on-year increase of 1.85%.

Domestic market cools down

Amidst an overall decline in the aerial work platform industry, the downturn is particularly pronounced in the domestic market.

According to statistics from the China Construction Machinery Association on major aerial work platform manufacturers, from January to July 2025, a total of 106,055 aerial work platforms were sold, a year-on-year decrease of 31.8%; of which, domestic sales were 41,794 units, a year-on-year decrease of 47.7%.

After ten consecutive years of growth from 2013 to 2023, domestic sales of aerial work platforms experienced their first annual decline starting in 2024, continuing into the first half of 2025 with a widening rate of decline.

Meanwhile, another noteworthy phenomenon in the aerial work platform industry is that while rental rates have increased, rental fees have decreased, indicating that profits from renting aerial work platforms have become lower.

According to statistics, the rental rate index for lifting work platforms in July 2025 was 688 points, a slight increase of 1.5% month-on-month and a slight increase of 6.3% year-on-year. The rental price index for lifting work platforms in July 2025 decreased slightly by 1.4% month-on-month and decreased by 14.8% year-on-year. Rental price indices for all models showed a downward trend year-on-year, with the smallest decrease being 6.7% for 8-12m models, while models over 40m saw a significant decrease of 17.8%.

Leading Leasing Companies Seek Solutions to the Downturn To cope with the decline in the high-rise work platform industry, my country's two leading leasing companies, Hainan Huatie and Hongxin Jianfa, quickly adjusted their operating strategies, mitigating the impact of the industry downturn on their businesses.

According to Hainan Huatie's semi-annual report, the company established a new RV business unit during the reporting period, officially entering the RV rental market and further optimizing its product portfolio. At the same time, Hainan Huatie comprehensively expanded its intelligent computing business segment, delivering computing power assets totaling over 1.4 billion yuan. Regarding financing channels, Hainan Huatie has issued or is planning to issue bonds and related products totaling 5 billion yuan, and is currently pursuing a listing in Singapore, enhancing its liquidity and risk resistance through diversified financing methods.

In the first half of 2025, Hongxin Construction Development optimized its asset structure through asset restructuring, trusteeship and liquidation, disposal of inefficient assets, and the addition of efficient assets. As of June 30, 2025, of the 202,600 aerial work platforms operated and managed by the group, 59,270 were entrusted to the group for operation and management by equipment holders outside the group through asset management services, a decrease compared to the same period last year. Furthermore, Hongxin Construction Development further improved resource utilization efficiency by selling and disposing of inefficient equipment and transferring some equipment to overseas markets.

Overseas markets have become the main battleground.

my country's construction machinery import and export trade volume reached US$35.076 billion from January to July 2025, a year-on-year increase of 10.5%. Exports amounted to US$33.486 billion, a year-on-year increase of 10.8%. Under this export growth trend, overseas markets for aerial work platforms have increasingly become the main battleground for major companies.

Zhejiang Dingli's report states that the global aerial work platform market structure is stable. Developed countries such as Europe and the United States have mature markets with well-developed product structures. Market demand mainly comes from replacement needs, and the number of vehicles in use is steadily increasing. In the first half of 2025, Zhejiang Dingli achieved overseas market revenue of RMB 3.374 billion, a year-on-year increase of 21.25%.

Zoomlion's semi-annual report states that Zoomlion's products currently cover more than 170 countries and regions worldwide, with a balanced regional structure in overseas markets, effectively avoiding the risks of relying on a single market. Among them, high-meter aerial work platforms have achieved large-scale exports in Europe, the Americas, and the Asia-Pacific region, demonstrating significant technological leadership and product competitiveness.

The overseas market has not been without its challenges. In recent years, international trade has faced numerous unstable factors, including geopolitical tensions, trade barriers, industry policies, and maritime transport conditions, all of which introduce significant uncertainties. The United States and the European Union have both initiated anti-dumping and anti-subsidy investigations into aerial work platforms imported from China. These developments have negatively impacted the export of construction machinery products.

Overall, the aerial work platform market, currently undergoing a period of adjustment, still faces many unknowns and uncertainties, with both opportunities and challenges. In the short term, the Chinese aerial work platform market will likely maintain its current trajectory, influenced by previous developments; in the medium to long term, the pressure on domestic sales of aerial work platforms may further increase.

Relevant News

-

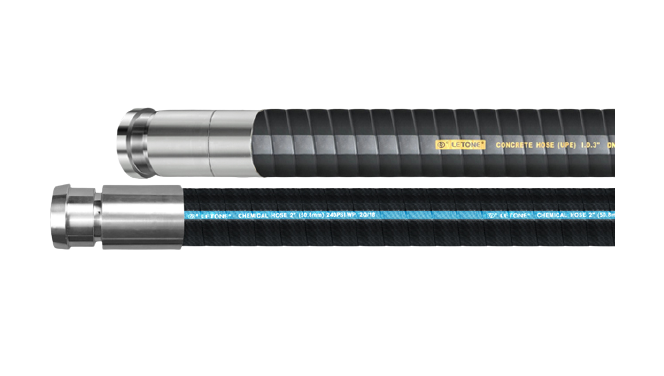

Innovation Empowerment | SUPER ARTERY LOW BEND SERIES Super Hercules Low Bend Series Hose

-

Kerosene cleaning objects and methods

-

Letone Hydraulics sincerely invites you to participate in the "19th Beijing Petroleum and Petrochem

-

Yu Wei, Deputy Mayor of Luohe City, came to investigate

-

Letone Hydraulics sincerely invites you to participate in the 19th China International Petroleum and

-

Letone Hydraulics sincerely invites you to participate in the "Germany Hannover Messe" and "BMW E

-

Letone Hydraulics (Booth No.10152) will meet you at the 2024 Abu Dhabi International Petroleum Expo

-

Up to $1.8 billion! High US tariffs could severely damage the construction machinery industry!