Is the Chinese construction machinery industry thriving in Southeast Asia or facing numerous challen

2025-10-10

Recently, Chinese construction machinery companies have made significant strides at major industry exhibitions in Southeast Asia. For example, at the Indonesian International Mining Exhibition, Zoomlion secured contracts worth over 700 million yuan in just two days, while Sany Group signed contracts exceeding 2 billion yuan on-site. At the Southeast Asia branch of the 3rd Changsha International Construction Machinery Exhibition in Malaysia, 11 companies, including Zoomlion, Sany Heavy Industry, LiuGong Machinery, and Sunward Intelligent Equipment, signed contracts totaling over 2 billion yuan!

The Southeast Asian market has become a crucial strategic region for Chinese construction machinery companies expanding overseas. With the deepening implementation of the Belt and Road Initiative and the continued growth of infrastructure construction in ASEAN, Chinese construction machinery companies have made significant progress in this market, leveraging their geographical proximity, high-quality products, and well-established service networks.

1.The Current Status of Chinese Construction Machinery in Southeast Asia

Driven by the Belt and Road Initiative and the RCEP (Regional Cooperation and Investment Partnership), the Southeast Asian market has attracted the attention of Chinese construction machinery companies due to its geographical advantages, high-quality and cost-effective products, and excellent service. These companies are actively participating in the local market not only by exporting equipment but also by investing in factories and participating in major engineering projects to enhance brand recognition.

In fierce competition with international brands, Chinese companies are gradually gaining more market share from Japanese brands that previously dominated the market. Indonesia, in particular, has long been a key export market for Chinese construction machinery in Asia, with exports to the country reaching US$1.37 billion in the first half of this year, a year-on-year increase of 28.2%.

Overall, Chinese construction machinery is making continuous breakthroughs in the Southeast Asian market, mainly reflected in the following aspects:

Firstly, the localization strategy is deepening. For example, Zoomlion has been accelerating its expansion in the Southeast Asian market in recent years, deploying nearly 30 outlets in Indonesia alone, covering various functions such as offices, showrooms, warehousing, and services. Currently, Zoomlion holds the number one market share in Indonesia for cranes, concrete machinery, and aerial work platforms, while its sales growth in earthmoving machinery and mining machinery has been among the industry leaders for many years.

Secondly, sales volume and market share are continuously rising. From January to August this year, LiuGong's equipment exports to ASEAN countries exceeded 5,000 units, representing a year-on-year increase of 45%. In the Indonesian market, it achieved a compound annual growth rate of over 100%, while in the Malaysian market, both sales volume and revenue increased by over 200% year-on-year.

Furthermore, Chinese construction machinery companies are gradually gaining more brand awareness and recognition in the Southeast Asian market through product structure optimization, electrification transformation, and participation in major infrastructure projects. Their participation in projects such as the China-Laos Railway and the Jakarta-Bandung High-Speed Railway demonstrates the reliability of Chinese brands' technology and their engineering adaptability.

2. Development Prospects of Southeast Asian Market

In recent years, Southeast Asia's economy has experienced sustained growth, rapid urbanization, and booming infrastructure construction, providing a broad market prospect for my country's construction machinery industry.

According to relevant statistics, in 2024, Southeast Asia accounted for four of the top 15 export destinations for my country's construction machinery products: Indonesia, Vietnam, Thailand, and the Philippines. Notably, Indonesia ranked as my country's third-largest export market, with exports reaching US$2.259 billion.

Looking at individual countries, Malaysia, driven by plans such as "Vision 2030," has seen continuous large-scale infrastructure projects. The "13th Malaysia Plan" plans to invest RM611 billion (approximately US$0.23 per ringgit) over the next five years (2026-2030), focusing on the development of transportation and communications, education, health, water management, housing, and green energy.

On August 19th, Vietnam held groundbreaking and completion ceremonies for approximately 250 large-scale projects nationwide, including key projects such as the Rach Mieu 2 Bridge in the Mekong Delta, the Saigon Coastal International Financial Center, and the Hanoi National Convention Center. These projects cover multiple sectors including transportation, urban development, and scientific research, with a total investment estimated at 1280 trillion Vietnamese dong (approximately US$50 billion).

Indonesia continues to increase investment in infrastructure construction and mining development, providing a huge market space for the construction machinery industry. It is understood that Indonesia's coal reserves are approximately 58 billion tons, with proven reserves of 19.3 billion tons, of which 5.4 billion tons are commercially exploitable. Furthermore, the Indonesian government's "raw ore export ban" has promoted local processing, resulting in a mining market worth hundreds of billions of dollars in the past two years and a surge in demand for mining equipment.

The construction of highways, railways, and ports throughout Southeast Asia is in full swing, creating a promising market outlook for construction machinery.

Furthermore, Southeast Asia is also entering a period of equipment replacement. For example, Indonesia had approximately 279,000 construction machines at the end of 2023, of which 41.8% were over 10 years old, indicating a significant demand for replacements.

Overall, the Southeast Asian markets are at different stages of development, providing diversified business opportunities for Chinese construction machinery exports. Traditional earthmoving and concrete machinery are indispensable in real estate and road construction; with increasing environmental awareness, the demand for energy-saving and environmentally friendly construction machinery is growing; and intelligent and digital products, such as equipment with remote monitoring and intelligent diagnostic functions, are also gaining market favor.

3. Challenges faced by domestic brands in Southeast Asia

Competition from international brands is fierce. The Southeast Asian construction machinery market is mainly dominated by internationally renowned brands such as Caterpillar and Komatsu. These brands occupy a large market share due to their advanced technology, high-quality products, and comprehensive after-sales service. Although Chinese brands are gradually gaining market share through cost-effectiveness, the competitive pressure remains significant.

Sales channels and localized services are relatively underdeveloped. Chinese construction machinery in Southeast Asia relies mainly on a few dealers for promotion, resulting in limited market coverage. In contrast, Japanese and American brands have established extensive sales networks through long-term cultivation of the Southeast Asian market. The Southeast Asian market has high requirements for after-sales service for construction machinery, but Chinese companies' after-sales service systems in the region are not yet comprehensive.

Political environment and policy risks. The economic development levels in Southeast Asia vary widely, and the political situation in some countries is uncertain, posing risks to the market expansion of construction machinery companies. For example, the first phase of the China-Thailand high-speed railway project, which started construction in 2015 and was originally scheduled to open in 2028, has progressed slowly due to multiple changes in government in Thailand, insufficient policy continuity, and multiple external factors, with only about 35% completed to date.

Supply chain and cost pressures. In some parts of Southeast Asia, the shortage of spare parts necessitates reliance on multinational supply chains, increasing costs and uncertainty. Furthermore, inadequate infrastructure, such as electricity and transportation, in many parts of Southeast Asia also constrains the expansion and development of Chinese companies. Additionally, the scarcity of senior management and technical personnel and relatively low labor productivity in these regions necessitate the deployment of expatriates, increasing operating costs.

Chinese construction machinery companies face numerous challenges in Southeast Asia, including brand image, sales channels, market competition, supply chain support, policy environment, and technological upgrades. To consolidate and expand their market share in Southeast Asia, companies need to enhance brand influence, optimize sales channels, improve after-sales service, strengthen localization operations, address international competition, and accelerate technological innovation.

Relevant News

-

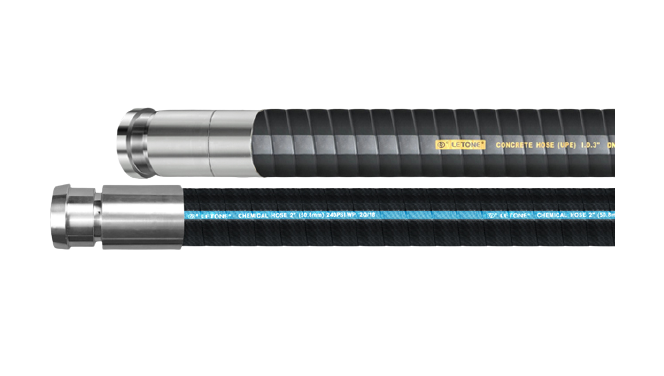

Innovation Empowerment | SUPER ARTERY LOW BEND SERIES Super Hercules Low Bend Series Hose

-

Kerosene cleaning objects and methods

-

Letone Hydraulics sincerely invites you to participate in the "19th Beijing Petroleum and Petrochem

-

Yu Wei, Deputy Mayor of Luohe City, came to investigate

-

Letone Hydraulics sincerely invites you to participate in the 19th China International Petroleum and

-

Letone Hydraulics sincerely invites you to participate in the "Germany Hannover Messe" and "BMW E

-

Letone Hydraulics (Booth No.10152) will meet you at the 2024 Abu Dhabi International Petroleum Expo

-

Up to $1.8 billion! High US tariffs could severely damage the construction machinery industry!